It’s a definite maybe!

If you’ve been watching the market, you’ve probably noticed a flood of price “improvements” and new inventory hitting the market. You may be asking yourself, “Has the market peaked?”, “Are prices coming down?”, or “Is the crash finally happening?”. Well, I can confidently answer one of those: There is currently no crash. However, that doesn’t mean price increases haven’t finally slowed down or possibly plateaued.

I know that is all very non-committal, but the data isn’t exactly conclusive. At least, not yet. Those of us in the industry seem to agree that things are “slowing down”. But what does that really mean? Pre-COVID, real estate had seasons, and this was typically the slow season due to vacations and people focusing on things other than real estate. We’ve been spoiled over the past several years with the market behaving in a predictable (although depressing) fashion. It certainly feels like things are slowing down, but are we finally heading back to a normal real estate market, or have prices finally hit the point where buyers are tapping out? Personally, I think the answer is “yes”.

For those of you who know me, you know I’m a numbers guy. I never met a spreadsheet I didn’t like. So, let’s look at some numbers comparing last year vs. this year in a 90-day window.

2023 vs 2024 Real Estate Market Comparison

- Number of Homes Listed: The number of homes listed is UP 18% compared to last year.

- Days on Market (DOM): The days on market is significantly DOWN. (DOM is measured from the day the property was listed to the day it is no longer being shown or is “pending”. It is NOT the number of days from list to close.)

- Average Days from List to Close: Lower, from 62 days to 38 days.

- Average Sale to List Ratio: Unchanged at 104%.

- Average Sale Price: Increased 11% to $810K.

- Average Size of Homes Sold: Consistent from year to year at roughly 2400 sq ft (this shows that the price increase is not due to larger homes being sold off).

Looks pretty good for Sellers, right? Prices are up 11%, the list to sale ratio is the same, and days on market are down. But these are all lagging indicators. A lagging indicator measures something that has happened in the past. Leading indicators are data points that predict what might happen in the future. So, while the average list to sold ratio measures what already happened, a data point like price reductions would indicate what is GOING to happen. Let’s look at some leading indicators.

Leading Indicators: Price Reductions and Unsold Properties

Let’s start with the properties that were listed but never sold. The numbers below are the percentage of unsold compared to the listed in that month:

- April 2023: 8%

- April 2024: 14%

- May 2023: 12%

- May 2024: 28%

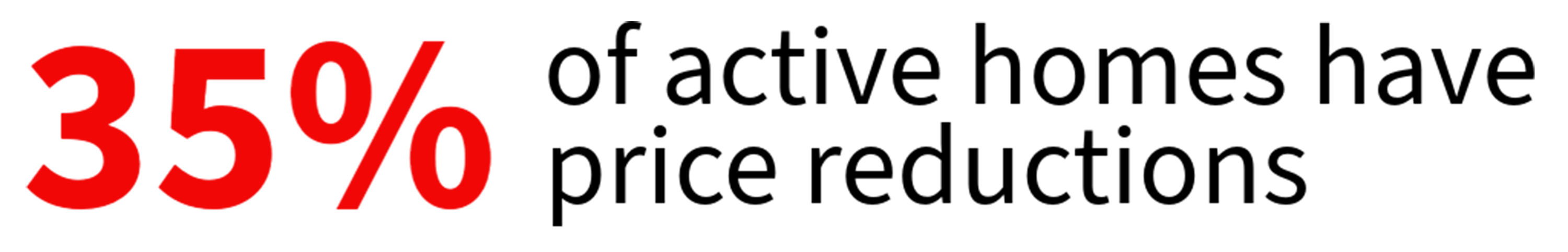

June numbers are unreliable (and May is suspect) because the average days to close is more than one month. However, it doesn’t look great. The number I find startling is the number of active listings (homes that are on the market currently but have not been put under contract) with price reductions.

That number is 35%.

What does all this mean? I’m not entirely sure, but my gut tells me that an 11% YoY price increase is probably no longer viable. I also think that we are seeing a seasonal slowdown and some agents/sellers have prematurely hit the panic button and dropped the price.

Advice for Buyers and Sellers

- For Buyers: If you see a price reduction, jump on it. In fact, ask for more. You’ll probably get it.

- For Sellers: If you do not need to sell, sit tight and ride it out. You may end up dropping the price anyway, but I would wait until later in July before you do. If you NEED to sell the house now and it’s been on the market longer than the average DOM for your price range in your area, you need a price reduction. One that’s going to get a buyer’s attention, probably in the range of 10% or so.

As we navigate through these uncertain times, it’s essential to stay informed and be strategic about your real estate decisions. The market is showing signs of change, but whether this will lead to a significant downturn or just a seasonal adjustment remains to be seen. Keeping an eye on leading indicators and being flexible with your approach will be key to making the most of the current market conditions.

Are you thinking of buying or selling your home? Now more than ever, having an experienced realtor by your side can make all the difference. Contact me today to discuss your options and get a tailored strategy that fits your needs. Whether you’re looking to capitalize on current trends or prepare for future shifts, I’m here to help you every step of the way.